Do you know why Rahul Dravid is called ‘Mr. Dependable’?

He is known as ‘Mr. Dependable’, not because he rarely got bowled, but because of his knack for surviving long innings, especially during challenging times when wickets were tumbling. One memorable instance was during a Test match against Australia in 2008 when he defended 40 balls against a formidable bowling attack.

Just as India often relied on him in the game and now as an Indian National Team Coach, investors rely on Fixed Deposits as a super dependable and secure option for investing their money. Moreover, Fixed Deposits can give high returns if planned intelligently.

In this blog, we’re going to explore the universe of Fixed Deposits and discuss why it could be beneficial for you.

What is a Fixed Deposit?

A Fixed Deposit is a type of investment where you deposit a certain amount of money to a bank or financial institution for a defined period. In return for this investment, you earn interest at a set rate. After maturity, the institution returns your original principal plus the interest earned until that point. Fixed Deposits can span various timeframes, ranging from shorter durations like 7-14 days to lengthier terms such as 10 years. Fixed deposits are also interchangeably known as term deposits.

History of Fixed Deposits in India

Fixed Deposit rates in India date back to the early 1900s when the British introduced fixed deposit schemes to encourage saving habits among Indians. However, the interest rates offered by banks were low and capped at a fixed rate, and hence only a few people invested in them. In the mid-1980s, fixed deposit interest rates were capped at 8%. Deregulation in 1992 introduced a 13% ceiling for tenors over 46 days. Today, banks are granted autonomy in setting interest rates and penalties for FDs.

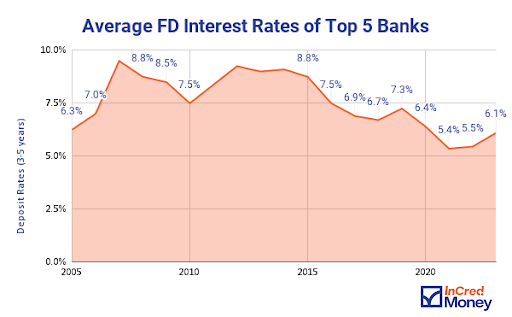

As per the chart, Fixed Deposit interest rates have steadily decreased since 2012 due to robust global liquidity and a downturn in economic activity in India. These rates typically fall following significant economic occurrences, such as the Global Financial Crisis (2009), the Rupee Crisis & Demonetization (2013-16), and the Covid (2020). However, once the crisis subsides and economic recovery begins, as observed in the periods of 2004-07, 2009-12, and 2017-18, interest rates begin to rise. A simple reason for this is when the government wants to promote savings over consumption, they increase the repo rates which in turn increases the interest rates. But when the government wants to promote consumption over savings, they decrease the repo rates which in turn decreases the interest rates.

What are Cumulative & Non-Cumulative FDs?

For example, if you choose to invest ₹1,00,000 in a fixed deposit for 5 years at an annual interest rate of 8%, your fixed deposit will mature to ₹1,46,933, earning ₹46,933 in interest. This is known as Cumulative FDs where principal plus interest is paid at maturity. You can refer to the table below –

| Year | Principal Amount | Interest Earned @8% p.a. | Amount at the end of the year |

| 1 | 100000 | ₹8,000 | ₹108,000 |

| 2 | ₹108,000 | ₹8,640 | ₹116,640 |

| 3 | ₹116,640 | ₹9,331 | ₹125,971 |

| 4 | ₹125,971 | ₹10,078 | ₹136,049 |

| 5 | ₹136,049 | ₹10,884 | ₹146,933 |

On the other hand, with non-cumulative FDs, interest will be paid out periodically. You can refer to the table below –

| Year | Principal Amount | Interest Earned @8% p.a. | Amount at the end of the month |

| 1 | 100000 | ₹8,000 | ₹108,000 |

| 2 | 100000 | ₹8,000 | ₹108,000 |

| 3 | 100000 | ₹8,000 | ₹108,000 |

| 4 | 100000 | ₹8,000 | ₹108,000 |

| 5 | 100000 | ₹8,000 | ₹108,000 |

| Total | ₹40,000 | ₹140,000 | |

Who can issue Fixed Deposits in India?

Scheduled Commercial Banks

All Scheduled Commercial Banks in India, including Public Sector Banks, Private Sector Banks, Foreign Banks, Cooperative Banks, and Small Finance Banks (SFB) are authorised to offer fixed deposits. These banks are regulated by the RBI.

NBFC

Not every NBFC can issue FDs to investors. NBFCs that have specific authorisation with an investment grade rating granted by an approved credit rating agency for deposit collection is allowed to issue FDs. These institutions undergo a rigorous regulatory process and comply with financial requirements set by the RBI. NBFCs issue Corporate Fixed Deposits which are similar to bank fixed deposits, but the interest rates offered can be higher.

Why are Fixed Deposits so popular in India

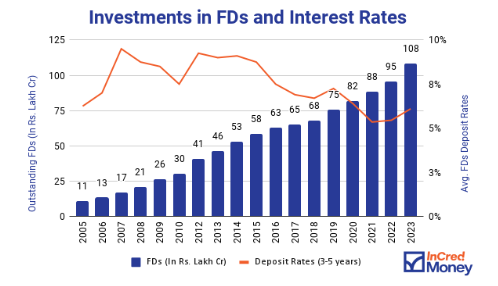

According to RBI data, despite interest rates on FDs dipping to as low as 5.5% in 2021 and 2022, we have seen a significant rise in the amount of money invested in FDs. But why do Indians love Fixed Deposits so much?

Easy to understand

Fixed deposits are straightforward and simple to understand. There are very few jargons involved.

Guaranteed Returns

Fixed deposit returns are ‘almost’ guaranteed. Banks and NBFCs that issue FDs are regulated by the RBI and hence are monitored thoroughly. The Credit Risk, which refers to the risk that the issuer may not be able to honour the principal and interest payments, is very low in the case of FDs. This makes the returns from FDs almost guaranteed.

High Stability

The interest rate at which a Fixed Deposit is bought will not increase or decrease at any time regardless of fluctuations in interest rates.

Tax Benefits

Certain longer-term fixed deposits might offer tax advantages under Section 80C of the Income Tax Act. Furthermore, if someone’s income falls below the taxable limit, they can still apply for an exemption from TDS by filling out either Form 15G or Form 15H.

Flexibility

The beauty of fixed deposits is the flexibility they offer: you can opt for short-term periods, such as 7 days or more, or for long-term options that can extend up to 10 years, based on your financial requirements.

But the most important aspect of FD is the additional set of security it comes with –

How are Fixed Deposits safe?

While your Bank Fixed Deposit is generally considered safe, with the most significant risk being potential loss due to bank insolvency, the probability of this occurrence is considerably low. Nevertheless, in such an unlikely event, additional security is provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a 100% subsidiary of the Reserve Bank of India (RBI). This institution provides a safety net for your deposited funds.

DICGC provides insurance coverage of up to ₹5 lakh per PAN per bank for all Bank deposits, including FDs. This insurance ensures that if your bank fails, DICGC will reimburse your deposit amount up to the insured limit.

Here are the types of banks that are insured under DICGC:

| Sr. No | Categories | Numbers |

| 1 | Public Sector Banks | 12 |

| 2 | Private Sector Banks | 21 |

| 3 | Foreign Banks | 44 |

| 4 | Small Finance Banks | 12 |

| 5 | Payment Banks | 6 |

| 6 | Regional Rural Bank | 43 |

| 7 | Local Area Banks | 2 |

| 8 | State Co-operative Banks | 33 |

| 9 | District Central Co-op Banks | 352 |

| 10 | Urban Co-op Banks | 1473 |

Source: DICGC (as of February 07, 2024)

Risks of investing in Fixed Deposits

Fixed Deposits are not completely risk-free, there are certain risks that we should be aware of:

Inflation Risk

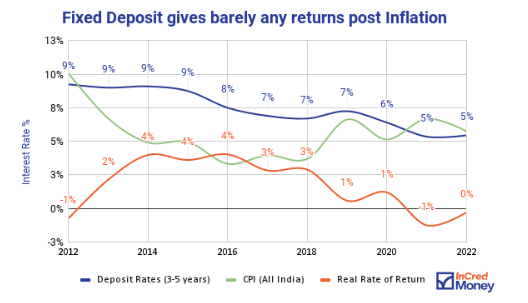

At times, interest rates struggle to match inflation in real return terms, leaving investors with little or no real returns. While the fixed interest rate of a Fixed Deposit is seen as an advantage, it can also be a disadvantage. If market interest rates rise after you invest in an FD, you may miss out on the chance to earn higher returns.

As we spoke about how interest rates struggle to match inflation in real return terms, what we mean is if the current inflation rate is 5.1% while your Fixed Deposit is offering 7.1%, your Real Rate of Return (RRR) would be merely 1.9%. On many occasions, FD returns are not able to beat inflation on a post-tax basis.

Penalty on early withdrawal

Early withdrawal penalties are fees charged by banks or companies, typically ranging from 0.50% to 1.00% of the interest earned, when depositors withdraw funds before the maturity date.

Taxation of Fixed Deposits

For individuals, the interest earned on FDs is taxed at the Marginal Tax Rate. So if you fall under the 30% tax slab, the interest that you receive would also be taxed at that rate.

Additionally, TDS is deducted from FD Interest u/s 194A of the Income Tax Act.

If the interest earned surpasses ₹40,000 (for non-senior citizens) or ₹50,000 (for senior citizens), the bank will deduct tax at the source before crediting the interest to your account.

So, if you were to receive ₹1,000, but 10% TDS was deducted, which equals ₹100, you would get only ₹900 (₹1,000 – ₹100). The bank then pays the deducted amount of ₹100 to the central government to fulfill their TDS obligation.

Why invest in FDs on InCred Money?

On the InCred Money platform, you can compare a host of Fixed Deposits across issuers and tenors and invest in the one that suits you the best. Here are some of the advantages of using the Incred Money platform to invest in Fixed Deposits:

Higher interest rates

FDs on the InCred Money platform will provide best-in-class interest rates of up to 9.25% p.a. for senior citizens and 9.01% for general investors.

(These interest rates are as of 6th Mar’24 and are subject to change from time to time)

Ease of Investment

Investors on the InCred Money platform can invest in FDs 100% digitally, within 5 minutes, and without needing to open a savings bank account.

ZERO Fees/Commissions

An investor has to pay ZERO fees/ commissions to invest in FDs via the InCred Money platform and can start investing with just ₹5,000.

One App – Multiple FDs

On the InCred Money platform, you have the flexibility to invest in multiple FDs from various banks.

InCred Money Pro

Invest ₹5 lakh in FD to become an InCred Money Pro Member and get Exclusive Benefits

- Early Access to all new Corporate Bond launches

- Dedicated Relationship Manager

- Get invited to Exclusive Events, Workshops & Webinars

FAQs

What is the minimum amount for a Fixed Deposit?

The minimum investment amount required for FDs on the Incred Money App is ₹5,000.

Are Fixed Deposits Safe?

Yes, FDs are regulated by the RBI, which means they are insured under DICGC, ensuring deposit protection with insurance coverage of up to ₹5 lakh per PAN per bank.

How much interest does Fixed Deposit earn?

Fixed Deposit in the InCred Money Platform provides up to 9.2% p.a. returns to senior citizens and 8.7% p.a. to general investors. These interest rates are as of 6th Mar’24 and are subject to change from time to time.

Can I break my Fixed Deposit before maturity?

Yes, but banks or companies will charge early withdrawal penalties, typically ranging from 0.50% to 1.00% of the interest earned, when depositors withdraw funds before the maturity date.