The last few years have been nothing short of extraordinary for equity investors worldwide. Despite the tumultuous impact of the Covid-19 crisis on global economies, equity markets have not only weathered the storm but have also shown remarkable resilience, emerging even stronger than before.

Since the onset of the Covid-19 pandemic, there has been an unprecedented surge in interest among retail investors in equities. Thanks to extensive investor education efforts by Mutual Funds, Brokers, & financial influencers, retail investors have invested heavily in the markets, leading to substantial wealth accumulation.

The infusion of liquidity by the US Central Bank, combined with robust retail investor participation and a buoyant corporate sector, has helped maintain market stability, preventing significant corrections over the past few years.

However, this prolonged period of stability has fostered a sense of complacency, with many now assuming that earning annual returns of 12%-14% in equities is a given. Such expectations, however, may be misplaced.

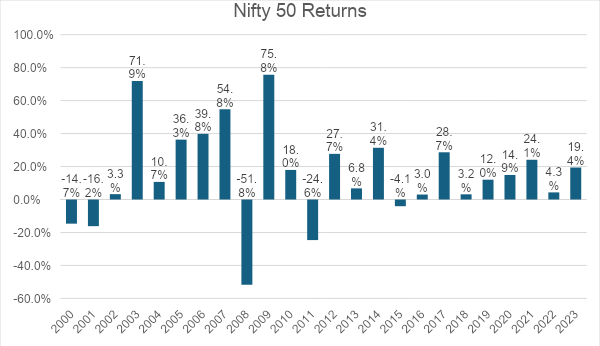

Here are a few interesting charts that reflect the unpredictable nature of Equity Markets:

Equities returns are bunched up

Equities usually give returns in a very bunched up manner. There will be a few years which will give you the maximum returns while most years will either give a low return or negative return.

Some years like 2008, can not just wipe out your funds but also your confidence.

Nikkei 225 – A 34 Year old chart that looks like a Skateboard rink

Would you have had the courage to invest in Japanese markets in 2010 for the long term had you seen the asset price bubble and the subsequent depressed Equity returns? Mostly, no.

After 34 years, Nikkei 225 is FINALLY near the highs made in 1989.

It’s also benefited by investments in Equity Market by Bank of Japan, probably the only Central bank that invests in Equities. Notably, in 2019, BoJ held 4.7% of total Market cap of Nikkei 225

GDP Growth ≠ Stock Market Returns

Chart of Shanghai Stock Exchange Index

China has been the second fastest growing economy after India, but it’s Equity returns are hardly anything to boast about.

Shanghai Composite Index has given only ~7% absolute returns in 5 Years v/s Nifty 50 which has given ~103% absolute returns in the same time frame.

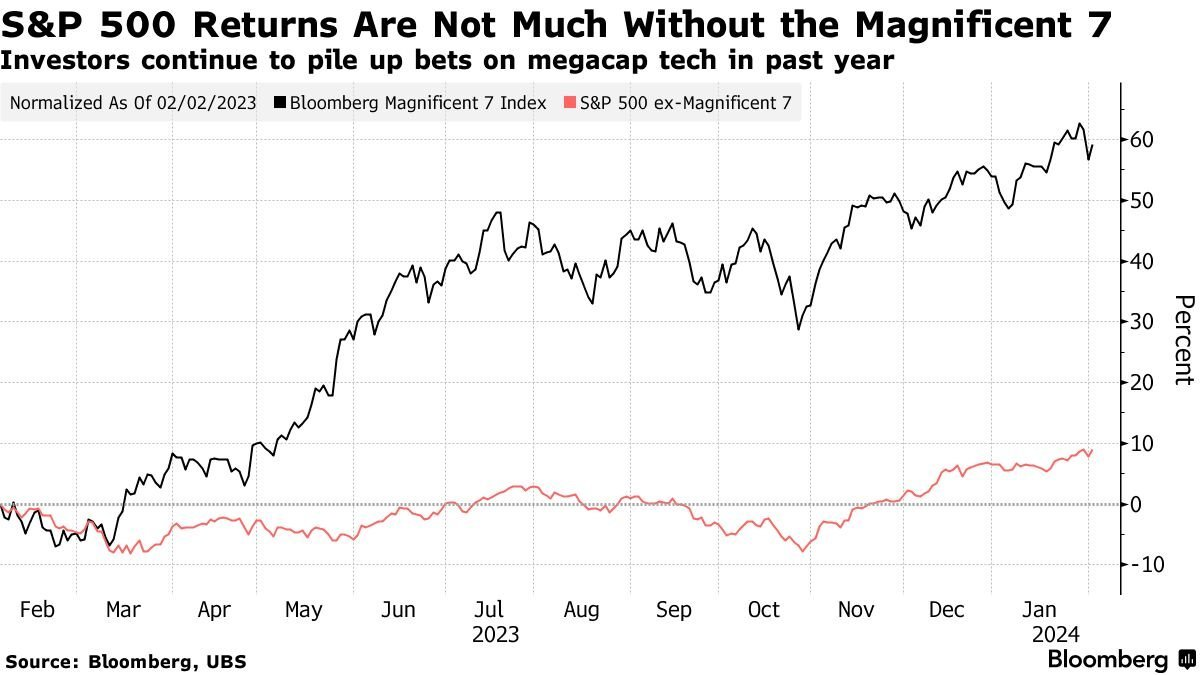

What if the Magnificent 7 stop outperforming?

The Magnificent 7 include – Apple, Microsoft, Alphabet (Google), Amazon, Facebook (Meta), Nvidia, Tesla

US markets are at all time highs – mainly because of the extra-ordinary strength of the Magnificent 7. Experts feel that the AI hype has gone overboard, and if that’s true – US Equities can be in for a tough time in the future.

Fun Fact: The market cap of the Magnificent 7 is a staggering ~13 Trillion USD, which is more than 3 times India’s market cap of ~4.15 Trillion USD.

Moral of the story:

Don’t take Equity Returns for granted. With the current economic conditions, Equities still look to be a good bet. But we can never predict the long term.

As these three charts show, the stock market can be unpredictable. One wrong move and you may not make the best returns. That’s why it’s always best to diversify your portfolio and keep risk in mind while investing.

Explore asset classes like Gold, High Yield Corporate Bonds, Market Linked Debentures, Real Estate, etc. which may prove to be a hedge (protection) when your Equity Portfolio is not doing well.

Till the next time,

Happy Investing,

Vijay