When it comes to investing in bonds, a lot of jargon is tossed around that sometimes goes above your head. Some terms you must’ve heard of are coupon rate and yield. Although many use these terms interchangeably, they have different meanings attached to them. In this article, we have explained in detail the coupon rate and yield and how they differ from each other with examples.

What is a Coupon of a Bond?

Governments and corporations issue bonds to raise funds for their activities. The bond issuer promises to pay you regular interest payments. These are typically annual or semi-annual at the specified coupon rate indicated in the bond documents. This interest is disbursed at the set frequency until the bond reaches maturity.

The coupon rate represents the interest rate that bond issuers commit to paying on the bond’s face value. The coupon amount is calculated on the bond’s face value (or par value) rather than the issuance price or market value. Let’s understand this with an example.

Suppose you buy a 10-year bond at Rs 2,000 (face value) with a coupon rate of 10%. You will receive Rs 200 as coupon payments (annually) for the entire 10-year period, regardless of any fluctuations in the bond’s market value.

Also, most people confuse the coupon rate with the actual return that they can earn. They are quite different.

Let’s understand the difference between the two with a simplistic example given below example. In the above scenario, you get Rs 200 as an annual coupon payment (10% of Rs 2,000), resulting in an effective interest rate of 10%.

However, if the bond is purchased above its face value, such as Rs 3,000, the coupon payment remains at 10% of the face value (Rs 200). Here, the interest rate will be calculated based on the purchase price. In this case, the return would be 6.67% (Rs 200 of Rs 3,000).

On the other hand, if the bond is bought below its face value, say at Rs 1,000, the annual payment remains Rs 200, resulting in a return of 20% (Rs 200 of Rs 1,000).

What is Yield to Maturity (YTM)?

The term “yield to maturity” (YTM) denotes the overall anticipated return on a bond if you hold it to maturity. YTM represents the internal rate of return (IRR) of an investment in a bond, assuming you hold the bond until maturity, receive all scheduled payments, and reinvest them at the same rate.

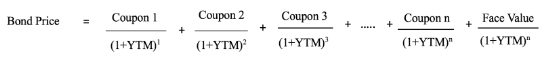

YTM considers the present value of a bond’s future coupon payments, incorporating the time value of money.

Formula

Example of YTM for Bonds

Consider a bond with a face value of Rs 1,000, an annual coupon rate of 6% paid annually, and a time to maturity of 5 years. If the market price of the bond is Rs 1,000, 900, and 1,100. Let’s see what the YTM is in each of these scenarios.

Scenario 1 – Market Price of the Bond is Rs 1,000

Rs 1000 = 60/(1+YTM)^1 + 60/(1+YTM)^2 + 60/(1+YTM)^3+ 60/(1+YTM)^4+ 60/(1+YTM)^5+ 1000/(1+YTM)^5

Calculating YTM through this method is usually known as the trial and error method. This is because we will use different scenarios to find the approximate return from the bond.

Here, since the face value and market price are the same, the YTM will be equal to coupon rate which is 6%.

Scenario 2 – Market Price of the Bond is Rs 900

Rs 900 = 60/(1+YTM)^1 + 60/(1+YTM)^2 + 60/(1+YTM)^3+ 60/(1+YTM)^4+ 60/(1+YTM)^5+ 1000/(1+YTM)^5

At the market price of Rs 900, the required yield to maturity will be around 8.55%.

Scenario 3 – Market Price of the Bond is Rs 1,100

Rs 1100 = 60/(1+YTM)^1 + 60/(1+YTM)^2 + 60/(1+YTM)^3+ 60/(1+YTM)^4+ 60/(1+YTM)^5+ 1000/(1+YTM)^5

At the market price of Rs 1,100, the required yield to maturity will be around 3.76%.

| Price of the Bond | YTM |

| 1,000 | 6% |

| 900 | 8.55% |

| 1,100 | 3.76% |

What is XIRR?

Extended Internal Rate of Return (XIRR) is a metric used to calculate the return from an investment when multiple cash flows are involved. It considers all cash flows from an investment, including the investment, returns, and maturity corpus. Unlike compounded annual growth rate, it tells the exact return from your investment.

XIRR is an important metric for investors as it helps compare the returns of different investments in a portfolio. Although it is mostly used to calculate the returns from a Systematic Investment Plan (SIP), XIRR can be used for any investment that has multiple cash flows.

Since bonds pay regular interest, you can estimate the exact return or yield from your investment in a bond through XIRR. Moreover, it gives the exact return even if you purchase the bond from the secondary market or sell it before maturity. However, when using XIRR to calculate the yield from your bond investment, it is assumed that the returns are reinvested at the yield. However, this might not always be the case, and the actual yield can be slightly lower.

The XIRR of the bond is also its Yield to Maturity (YTM) and hence both these terms are used interchangeably.

Formula

XIRR is usually calculated using Microsoft Excel or Google Sheets. The formula to calculate XIRR is given below.

XIRR = XIRR (value, date)

Where values are the cash flows, both inflows and outflows,

The date is the respective day when you receive a coupon and principal payment.

Example of XIRR in Bonds

Let’s understand XIRR with the help of an example. If you invest Rs 1 lakh in Neo Growth Bond in September 2023, that pays a coupon rate of 11.25%. The coupon payment is done every quarter and matures in October 2024. Then, your expected XIRR from the bond will be calculated as follows.

| Particulars | Date | Value |

| Investment | 27/09/23 | -100,000 |

| Coupon payment | 31/12/23 | 2,812.5 |

| Coupon payment | 31/03/24 | 2,812.5 |

| Coupon payment | 30/06/24 | 2,812.5 |

| Coupon payment | 30/09/24 | 2,812.5 |

| Principal repayment | 28/10/24 | 100,937.5 |

| XIRR | 11.7% |

Although the coupon rate is 11.25%, the actual return from your investment in Neo Growth Bond is 11.7%. This is primarily because the coupon payment is made quarterly. If the coupon payment is made annually, then the coupon rate and the yield will be similar. The higher the number of coupon payments in a year, the higher will be the yield when compared to the coupon rate.

Difference Between Coupon and Yield to Maturity (YTM)

YTM and coupon are sometimes used interchangeably, but there are a lot of differences between the two. A coupon is the interest paid to the bondholder regularly until maturity. The coupon payments are fixed payments done monthly, quarterly, half-yearly, or even annually.

Market interest rates do not affect the coupon rate as it is fixed by the issuer even before the bond is issued.

On the other hand, YTM is the total annual return from the bond. It includes the regular coupon payments and the capital gains on the bond.. The yield from a bond fluctuates based on the market interest rates. This is primarily because the bond prices and interest rates are inversely related. If interest rates fall, the price of the bond increases. Hence, you can sell the bond at a premium..

Coupon and yield are the same only if the bond price remains unchanged or the investor holds it until maturity and gets the principal amount. However, if the bond price falls or rises, the yield will not be the same as the coupon.

Example

Let’s understand the difference between coupon and yield with the help of an example.

A bond is issued at Rs 900 and pays a fixed coupon of Rs 80 per annum for a duration of 3 years. After the bond is matured, the issuer pays back the face value of Rs 1,000.

In this case, the coupon payment is 8% (Rs 80/1,000). However, the yield will not be the same as the coupon payment. We can calculate the yield through XIRR, as shown below.

| Particulars | Date | Value |

| Investment | 01/01/18 | -900 |

| Coupon payment | 01/01/19 | 80 |

| Coupon payment | 01/01/20 | 80 |

| Coupon payment | 01/01/21 | 80 |

| Price of the bond | 01/01/21 | 1,000 |

| XIRR | 12.2% |

Since the bond is issued at a lower price than its face value and redeemed at par, the YTM or yield is higher than the coupon. Usually, an increase in interest rates leads to a discounted price of the bond which keeps the coupon rate constant but increases the yield.

Suppose the bond is issued at Rs 1,100, and redeemed at par, then the yield will be lower than the coupon rate. A fall in interest rates leads to the premium price of the bond which keeps the coupon rate constant but decreases the yield.

| Particulars | Date | Value |

| Investment | 01/01/18 | -1100 |

| Coupon payment | 01/01/19 | 80 |

| Coupon payment | 01/01/20 | 80 |

| Coupon payment | 01/01/21 | 80 |

| Price of the bond | 01/01/21 | 1000 |

| XIRR | 4.4% |

Suppose the bond is issued and redeemed at par, then the yield and coupon rate will be the same.

| Particulars | Date | Value |

| Investment | 01/01/18 | -1000 |

| Coupon payment | 01/01/19 | 80 |

| Coupon payment | 01/01/20 | 80 |

| Coupon payment | 01/01/21 | 80 |

| Price of the bond | 01/01/21 | 1000 |

| XIRR | 8.0% |

Conclusion

Both coupon rate and yield are important bond terminology that you must know. The relationship between the two is also very important as it will help make investing decisions. Understanding how yield changes based on market conditions will help you make informed decisions.

Frequently Asked Questions (FAQs)

Is yield equal to coupon?

The coupon and yield are different. A coupon is the predetermined interest rate the bond issuer pays the bondholder each year. While yield is the actual return you earn from holding the bond for a year.

What is the yield in bonds?

A bond’s yield is the return you can expect to receive each year.

What is the difference between coupon rates and YTM?

The coupon rate remains fixed throughout the year, and the YTM fluctuates based on various factors, including the current market price of the bond and the remaining years until maturity.

Can the coupon rate be higher than the yield to maturity?

If you purchase a bond at its par value, the YTM equals the coupon rate. If you purchase the bond at a discount, its YTM will always be higher than its coupon rate.