When it comes to finding alternatives to stocks, two of the most preferred investments are either bonds or fixed deposits. This is because both the instruments pay a fixed interest to the investors for a fixed period of time. They also provide capital protection and offer stable income. However, the similarity ends there. Bonds and fixed deposits differ on several parameters, and it is important to know their differences to choose the best investment for your portfolio.

Bonds vs Fixed Deposits: At a Glance

Here’s a quick comparison between bonds and fixed deposits, and in the next section we compare these in detail.

|

Parameter |

Bonds |

Fixed Deposits |

| Definition | Fixed-income securities that offer a stable income. | Deposits that offer a stable income. |

| Issuer | Government and public and private companies which include Banks and NBFCs | Banks, post offices, non-banking financial companies |

| Minimum Investment | Rs 10,000 to Rs 1,00,000 | Rs 1,000 |

| Returns | 7-13% | 3-8% |

| Frequency of Payout | Decided by the bond issuer | Decided by investor |

| Tenure | One year and above | Seven days to 10 years |

| Liquidity | Bonds are transferable and can be sold subject to availability of a buyer | FDs are not transferable and can only be pre-matured by paying a penalty |

| Loan against security | Available but with a low loan-to-value ratio. Many banks and NBFCs offer loans against bonds, however, these bonds must be issued by recognised entities. | Available with a high loan-to-value ratio |

| Collateral | Secured Bonds are backed by physical or financial assets which can be liquidated in case of a default | FDs are unsecured and not backed by physical or financial assets |

| Insurance | There is no insurance by a third party in case of a default. | Bank FDs up to Rs 5 lakh are insured by Deposit Insurance and Credit Guarantee Corporation (DICGC). Corporate FDs are not insured. |

| Risk | Low to high risk depending on various factors like the issuer, collateral, credit rating, etc | Low risk to medium risk |

| Credit Rating | All listed bonds have a credit rating | Only FDs issued by NBFCs have a credit rating |

| Taxation | Interest is taxable as per applicable slab rates. and capital gains are taxable | Interest is taxable as per applicable slab rates. |

| Who can consider investing | Seeking predictable but higher returns than FD | Conservative investors seeking Low-risk and guaranteed returns |

Bonds vs Fixed Deposits: In Detail

Definition

Bonds are financial instruments that governments and corporations issue to raise capital. They are fixed-income securities that offer a stable income to the investors. Fixed deposits, as the name suggests, are a type of deposits where investors receive a fixed interest for a specific period of time against a certain sum of money deposited by them.

Issuer

Bonds are issued by governments, both state and central, public sector companies, and private sector companies including banks and non-banking financial companies (NBFCs). In contrast, fixed deposits are issued only by banks, post offices, and NBFCs.

Minimum Investment

The minimum investment in bonds or debt IPO (initial public offering) ranges between Rs 10,000 to Rs 1 lakh. For fixed deposits, the minimum investment starts from Rs 1,000 with no limit on the maximum investment.

Returns

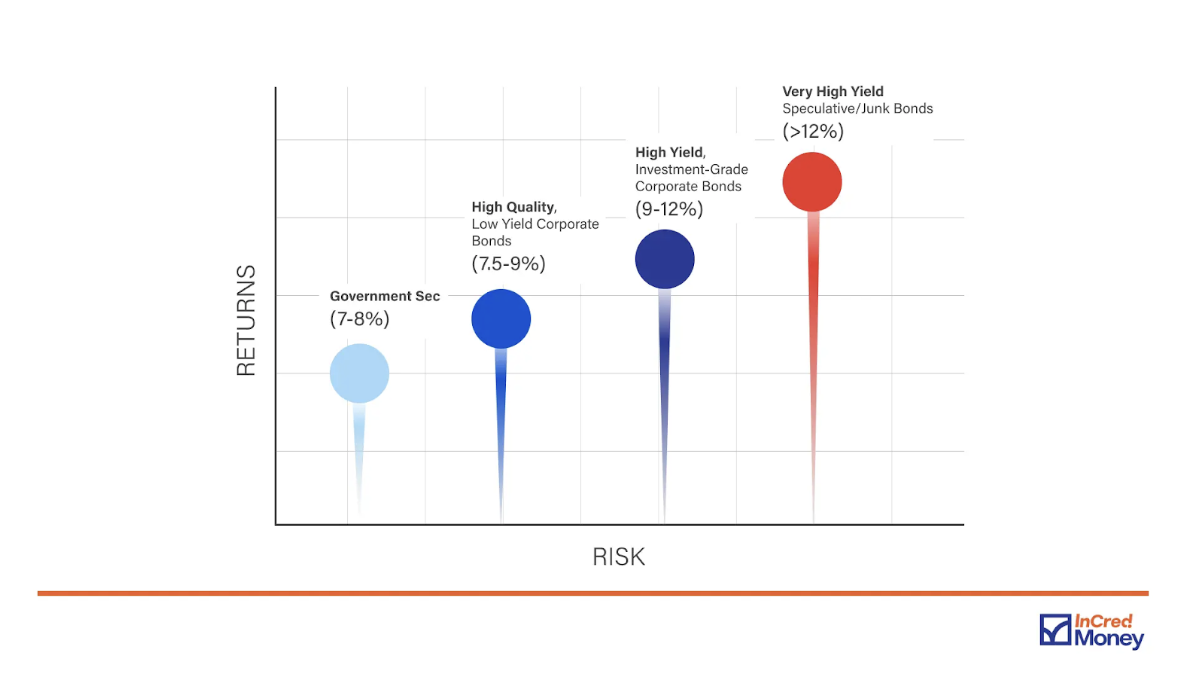

Bonds usually yield a higher return than fixed deposits. The return from bonds ranges between 7% to 12% depending on the credit rating of the bond and the interest rates in the economy during that period.

In contrast, the interest on fixed deposits ranges between 3% to 8% depending on the banks and investment tenor.

Bonds also give a higher return than inflation. Let’s understand this with an example: if you plan to invest Rs 1 lakh in an InCred Financial Services Bond , which is paying a fixed coupon of 10.28% with a maturity of 3 years. However, your mom suggested you invest the same in SBI fixed deposit which is paying an interest of 6.5% for the same tenure. If the inflation rate in India is 6%, let’s see what is the actual return from these investments after three years.

The pre-tax and post-tax return from your investment in the InCred Financial Services Bond and SBI Fixed Deposit is shown below.

| InCred Financial Services Bond | SBI Fixed Deposit | |||

| Pre-Tax | Post-Tax | Pre-Tax | Post-Tax | |

| Return (%) | 10.28% | 7.10% | 6.50% | 4.49% |

| Value (Rs) | 1,34,119 | 1,22,860 | 1,20,795 | 1,14,089 |

If you consider inflation, the real return from your investment is further reduced. The following table shows the return post inflation.

| InCred Financial Services Bond | SBI Fixed Deposit | |

| Return (%) | 1.100% | -1.5100% |

| Value (Rs) | 1,03,336 | 95,538 |

It can be clearly seen from the above table that bonds can give a higher return than fixed deposits and also beat inflation.

Frequency of Payout

You cannot select the interest payout frequency in the case of bonds, as the bond issuer decides it. In the case of fixed deposits, you can choose the interest payout frequency. Banks usually pay interest either fortnightly, monthly, quarterly, half-yearly, yearly or at the time of maturity. You can choose one based on your needs and goals.

Tenure

Bonds have a tenure ranging from one year to ten years or even more. . In the case of fixed deposits, the tenure ranges from 7 days to 10 years. You can choose a tenure based on your requirements.

Liquidity

Bonds trade on the secondary market, and hence, you can easily buy and sell them on the stock exchange, just like shares subject to availability of a buyer or seller. When compared to fixed deposits, bonds are very liquid. Once invested in a fixed deposit, you must stay invested until the end of the tenure. If you want to withdraw your investment before the tenure ends, banks will charge you a penalty in the range of 0.5%-1%. However, it is important to note that though you can sell your investment in bonds, it is best to hold them until maturity to dodge liquidity and interest rate risk.

Loan Against FD or Bond

You can take a loan against bonds and fixed deposits by pledging them to the lender. In the case of fixed deposits, the loan-to-value (LTV) ratio is 90%. This means banks give around 90% of the FD amount as loans. However, in the case of bonds, the LTV is 50-80% of the bond investment depending on factors like credit rating, issuer of the bond, etc.

Collateral

Secured Bonds are backed by physical assets. This provides a sense of security for investors against default risk. Unlike bonds, FDs are not backed by any physical assets.

Insurance

Bonds are fixed-income instruments that offer regular returns. Government bonds are also known as sovereign bonds where it is safe to assume that credit risk is negligible. There is no insurance by a third party in case of a default in either Corporate bonds or Government Bonds

Though fixed deposits are considered the safest investment, banks do not guarantee capital protection. However, Bank FDs of up to Rs 5,00,000 are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Risk

Bonds can be high-risk or low-risk. Depending on the credit rating of the issuer, you can determine how risky the bond is. Bonds with high risk tend to offer high interest rates to compensate for the risk exposure.

Banks are considered to be the safest place to hold money. Thus, fixed deposits are often perceived to be risk-free. However, you must keep in mind that banks can go out of business, too. In such scenarios, only FDs up to Rs 5,00,000 are insured, and any excess amount is lost.

All debt instruments (FDs or bonds) are exposed to credit (default risk), interest rate risk (duration risk), inflation risk, and reinvestment risk.

Credit Rating

Credit rating agencies assign a credit rating to bonds. This rating reflects the issuer’s creditworthiness. Higher ratings indicate that the bonds have low risk. In contrast, lower ratings indicate higher default risk. Also, credit ratings have an impact on the interest rate that the bond offers.

Unlike bonds, bank fixed deposits do not have a credit rating. However, fixed deposits from corporations and non-banking financial companies (NBFCs) do have a credit rating. Higher credit ratings imply the safety of deposits.

Taxation

Returns from bonds are of two types: interest and capital gains. Interest payments are the regular income that you receive while you are invested in the bond. Capital gains are the profit you make by selling the bond before maturity.

Suppose you buy a bond that pays 7.5% interest for Rs 1,00,000. For this, you will receive Rs 7,500 as interest every year. If you sell the bond before maturity (at a profit), you may earn capital gains. Let’s say you sell it at Rs 1,20,000. Your capital gains will be Rs 20,000.

Next, bonds can be listed (on the stock exchange) or unlisted. The tax treatment for the two is different.

On the other hand, interest earned on fixed deposits is added to your total taxable income and is taxed as per the applicable income tax slab rate.

The following table summarizes taxation for listed, unlisted bonds and FDs:

| Taxation | Listed Bonds | Unlisted Bonds | Fixed Deposits |

| Tax on Interest | Applicable IT slab rate | Applicable IT slab rate | Applicable IT slab rate |

| Short Term Capital Gains | Less than 1 year: Applicable IT slab rate | Less than 3 years: Applicable IT slab rate | N.A. |

| Long-Term Capital Gains | More than 1 year: 10% without indexation benefit | More than 3 years: 20% with indexation benefit | N.A. |

Who Should Invest?

Investors with low-risk tolerance levels who are not comfortable investing in the stock market can invest in bonds. Bonds offer regular returns; thus, if you want regular income, bonds can be your pick.

Fixed deposits, on the other hand, also offer guaranteed returns. These are suitable for conservative investors. However, the returns from FDs are lower than bond returns. Thus, bonds are a good investment option if you are seeking low-risk, regular income and higher than FD returns.

Conclusion

While both bonds and fixed deposits offer secure investment options, bonds come out as a clear winner. Bonds typically provide higher returns than FDs, making them potentially more lucrative for investors seeking greater returns. In most scenarios, FDs have struggled to generate inflation-beating returns.

Additionally, bonds can be a good addition to your investment portfolio. Bonds offer good diversification with a balance between risk and return. However, the decision between bonds and FDs ultimately depends on your financial goals, risk tolerance, and investment preferences.