Back in 1989, Peter Lynch, one of the biggest investors, got a call from none other than Warren Buffet. He called for a very simple purpose. He wanted to use a quote by Peter Lynch from his book, ‘One up the Wallstreet’ in his Berkshire Annual Report.

The quote was, “Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

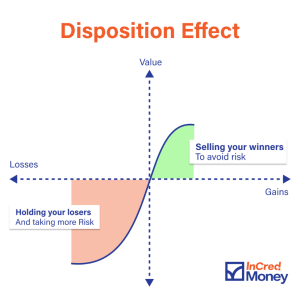

This is a classic case of the Disposition effect – Where we as investors sell our profitable positions while holding on to the losing ones.

Have a look at this graph below –

Disposition effect happens because of two common behavioural biases – Risk Aversion (when you want to sell your winners) and Loss Aversion (when you resist realizing your losses).

Let’s talk a bit about ‘Loss Aversion’ today.

In 2019, Zerodha, a leading broker, published data stating, “Nearly 2 lakh of our clients hold Yes Bank with an unrealized loss of over 59%; 1.25 lakh hold Ashok Leyland with loss of 40%; over 1 lakh hold Tata motors with over 51% loss.” This is classic example of ‘Loss Aversion’.

Loss aversion is a psychological phenomenon where people tend to feel the pain of losses more strongly than the pleasure of equivalent gains. In short, it means we would rather avoid losses than acquire equivalent gains.

What makes us afraid of losing money when we invest?

We get Married to our Investments!

This happens to the best of us. When we decide to invest in a stock after a lot of research, we become emotionally attached to its outcome. During periods of underperformance, we tend to actively seek out reasons for the stock’s potential recovery (also known as Confirmation bias).

We consider it as a personal failure to sell a loss-making stock, so we hold on till the time it breaks even or starts making profits. Sometimes we keep averaging the stock at lower levels and accumulate more units than what we had originally desired.

After experiencing a significant decline in a specific stock’s value, a common tendency for many investors is to sell the stock once it has rebounded back to the Cost price (i.e. on a No Profit No Loss basis).

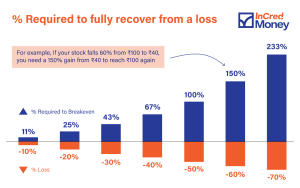

This Loss Aversion, many times however, leads us into a spiral of uncontrollable losses which makes it even more difficult to break even (Refer to the graph below).

As an investor, how can you prevent yourself from falling prey to Loss Aversion?

Detachment from the Cost Price: We get anchored to the Cost Price of our investments which then guides our decision making. If the factors supporting the decision to hold a stock have deteriorated, we must consider exiting the position irrespective of what the Cost Price was.

Put a Stop Loss: We should establish a predefined stop loss rule, such as setting it at 10% below the cost price. It’s important to be disciplined: once the stock reaches the stop loss level, we exit the position. Think of a stop loss like the saying, ‘A stitch in time saves nine.’ Trust me, as stock prices decline further, it becomes progressively more challenging to exit the position. For instance, selling a stock at a 20% loss is far more difficult than at 10%, and the challenge only increases from there.

So, are you also prone to this Loss aversion bias? Then I hope this piece helps you avoid it in the future.

Till the next time,

Vijay

CEO – InCred Money

P.S. I share my thoughts on Investing and the Economy regularly. You can follow me here.